This is a section on Indian bioplastics market & trends, presented by the Biopolymers consulting team @ Energy Alternatives India.

Drivers for the Bioplastics Market Growth in India

A number of key drivers are accelerating the growth of the bioplastics market globally. Many of these are relevant in the Indian context too.

- Mandates & regulations

- Increasing eco-awareness among consumers

- Corporates becoming more focused on sustainability

- Technology stabilization

- Cost reduction

Challenges for Bioplastics

At the same time, bioplastics face critical challenges before they achieve large scale market penetration.

- They are much more costly than conventional plastics (could be 2-4 times as costly, depending on product)

- Upstream technology is still evolving, and hence there are uncertainties in technologies and processes

- Uncertainties present in post-use processing and end of life options for bioplastics

- Substitutes – some of them authentic and some not-so authentic substitutes – also present competitive challenges to the adoption of bioplastics in many mainstream markets

- Customer awareness – a number of misconceptions result in a poor and sometime faulty understanding of the market, resulting in delays in investment decision-making

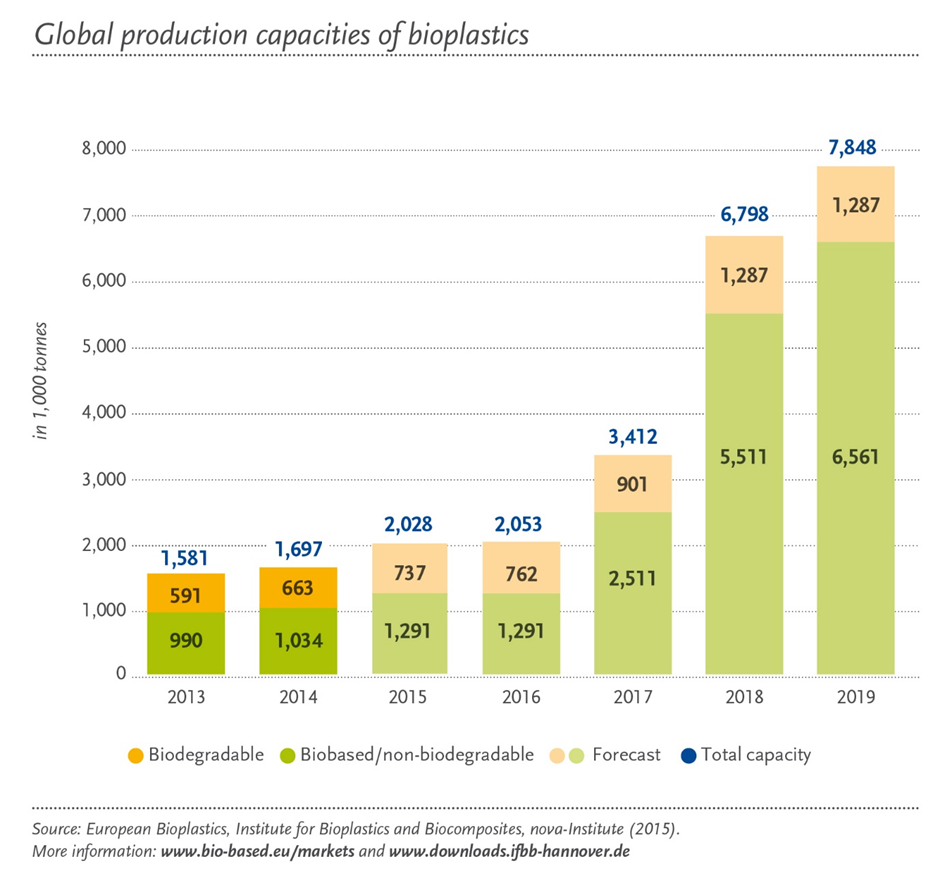

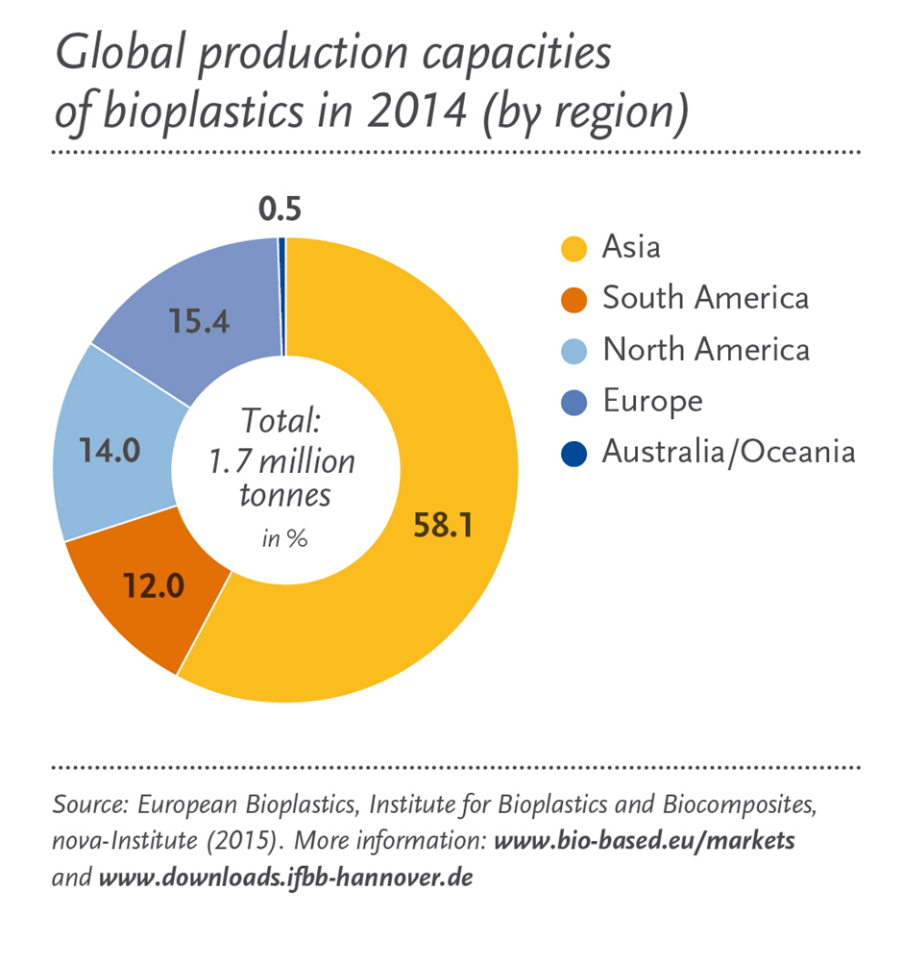

Currently, bioplastics represent about one per cent of the about 300 million tonnes of plastic produced annually. But as demand is rising and with more sophisticated materials, applications, and products emerging, the market is already growing by about 20 to 100 per cent per year. According to the latest market data compiled by European Bioplastics, global production capacity of bioplastics is predicted to quadruple in the medium term, from around 1.7 million tonnes in 2014 to approximately 7.8 million tonnes in 2019.

Biobased, non-biodegradable plastics, such as biobased PE and biobased PET, are the main drivers of this growth. More than 60 percent of the bioplastics production capacity worldwide in 2014 was biobased, durable plastics. This share will increase to over 80 percent in 2019. Production capacities of biodegradable plastics, such as PLA, PHA, and starch blends, are also growing steadily, nearly doubling from 0.7 million tonnes in 2014 to well over 1.2 million tonnes in 2019. PHA production will double by 2019 compared to 2014, due to a ramp-up of old and new capacities in Asia and the USA.

PLA is expected to be the largest segment, in terms of volume, in 2015 with a market share of more than 45.1% of the total biodegradable plastics market. PLA is also expected to grow at the second-fastest rate among all the types of biodegradable plastics. The growth of PLA is expected to be driven by its superior mechanical properties and ease of processability. In terms of value, starch blends are expected to account for the largest share in the market during the forecast period. This is due to the comparative high cost of starch blends to PLA.

European Bioplastics estimated the top five bioplastics in 2010 by production capacity: biopolyethylene (bio-PE), biodegradable starch blends, polylactic acid (PLA), polyhydroxyalkanoate (PHA) and biodegradable polyester. By 2015, bio-PE, PLA, PHA and biodegradable polyester are anticipated to still remain in the top five. However, bio-polyethylene terephthalate (bio-PET) will replace biodegradable starch blends as one of the top five bioplastics.